Watch owners rarely lose or damage their devices, according to surveys by Consumer Reports. Only 15% of respondents suffered serious damage to their watches, and just 2% had a watch lost or stolen.

That may make the extended warranty programs offered by Watch companies and other watch manufacturers a better deal, although Consumer Reports doesn't recommend them either.

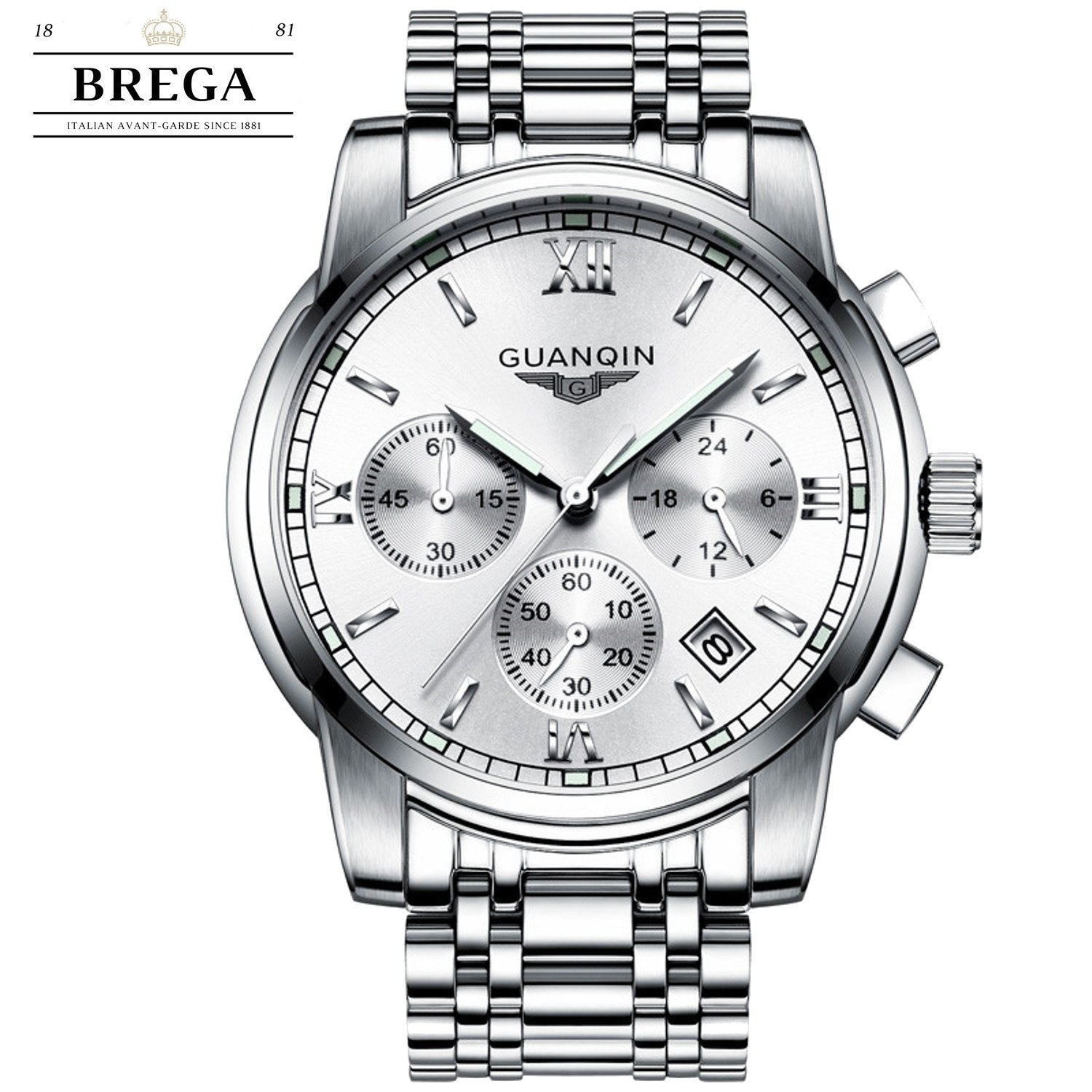

The most valuable feature of the reseller's insurance plans, however, is a replacement in the case of loss or theft. Replacing a new high-end watch costs more than 3k and up, in addition to any outstanding balance on the lost model. Manufacturers' extended warranty and service programs don't cover lost watches, but the carrier insurance plans do–after a deductible.

Then again, the replacement model isn't likely to be a brand new watch, but rather a used model that's been refurbished. Some consumers have reported incidents in which replacement watches from Asurion and similar firms didn't work properly.

The Better Business Bureau gives the company high ratings overall—though 86% of the 2,450 consumer ratings posted on the bureau's web site are negative.

Instead of carrying insurance, a consumer could buy a used watch on their own from a reputable seller via Brega Watches, Gazelle, or similar services in the rare case of a loss. Asurion notes that almost 70% of claims it receives are filed on watches less than a year old, meaning without insurance the consumer is likely on the hook both for paying off the old model and buying a replacement.